One of the biggest barriers to wide-scale adoption of quantum computing is a lack of solutions that fit users without detailed experience and knowledge with this technology. Multiverse Computing, a leading quantum software company building quantum and quantum-inspired solutions, is helping executives close that gap by developing tools that can tackle complex problems in finance. Their flagship product, Singularity, enables professionals with no background in quantum computing to take advantage of its early business value.

The Singularity for Credit Scoring App features a user-friendly Excel interface to allow finance and banking professionals to solve complex classification problems using quantum and quantum-inspired classifiers from their mac or pc. Classification in Machine Learning is a supervised ML method by which the model attempts to predict the correct label of a given input data. The finance sector regularly uses machine learning methods for credit scoring, fraud detection, trading, and more.

In the example below, we will show how a major European bank used a quantum classifier to solve a credit scoring problem better than a classical classifier.

Step 1: Formulation

Describe the credit rating problem in terms of binary classification:

· 0: Borrower can repay

· 1: Borrower fails to repay

Next, input examples of borrowers that have successfully and unsuccessfully repaid loans with a variety of features or characteristics that contribute to prediction by the ML model. In this example, 1,000 examples are given for the quantum classifier with 10 features (loan amount, duration, work status, etc.).

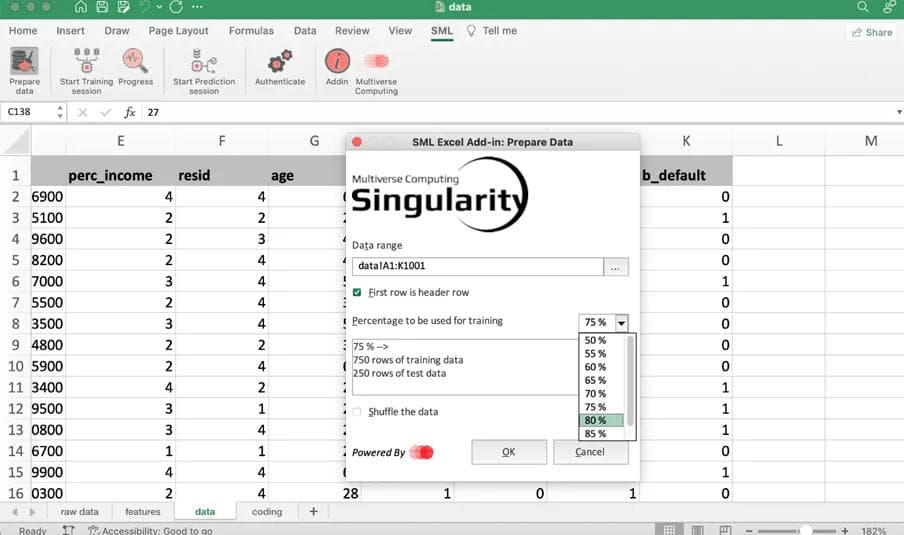

Step 2: Selection of training data

Before training begins, select the data along with the percentage of data to be used for training and testing.

Based on this selection, Singularity will create two new pages: a trained datasheet and a test datasheet.

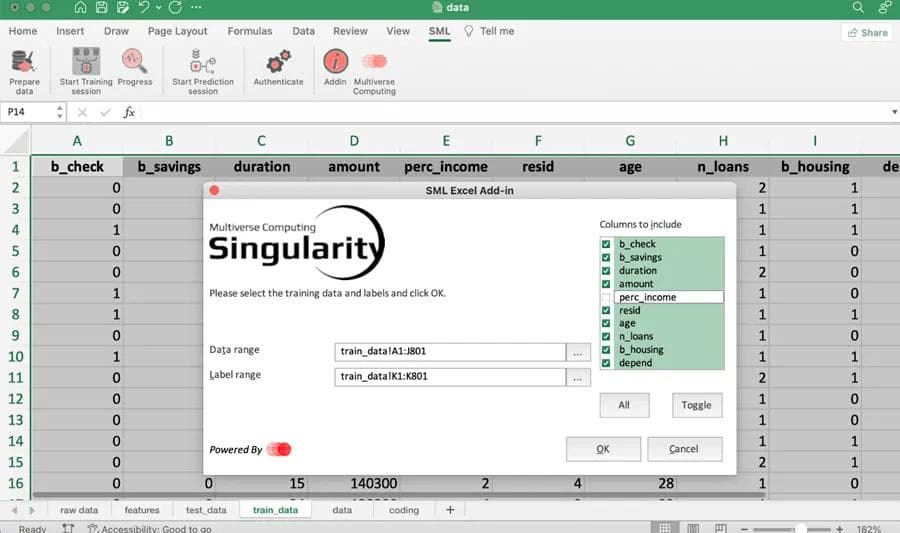

As shown in the trained datasheet above, the popup window can be used to do feature selection, where certain features that were added in step one can be selected and unselected based on preference.

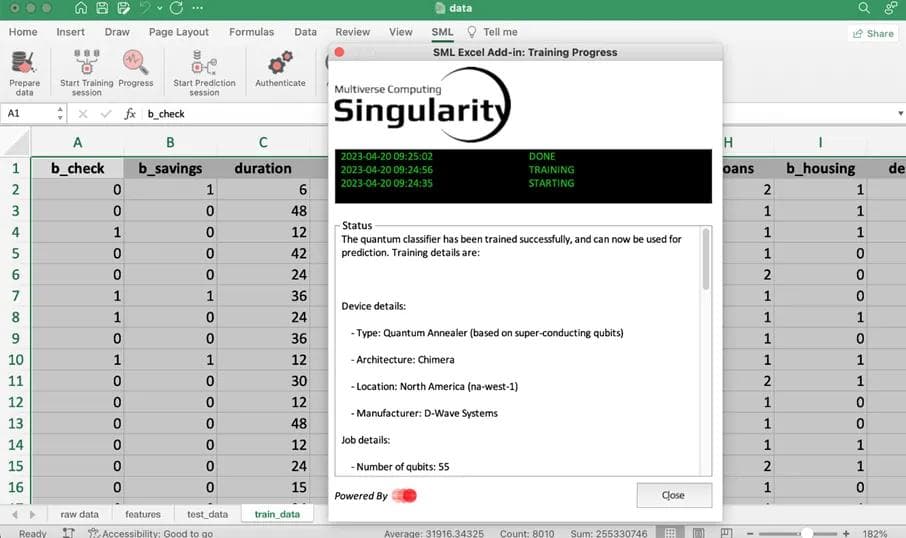

Step 3: Training

At this step, a hybrid quantum-classical or a quantum-inspired algorithm is trained on the selected training data and returns the final predictor. Once complete, the add-in provides the details of the job and training, including the number of qubits, optimization time, and total training time, normally of the order of 30–50 seconds.

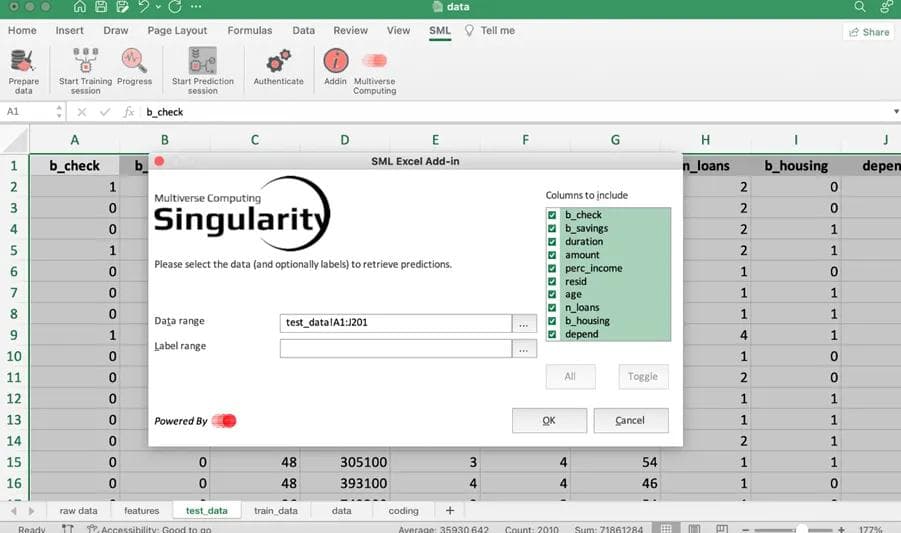

Step 4: Prediction

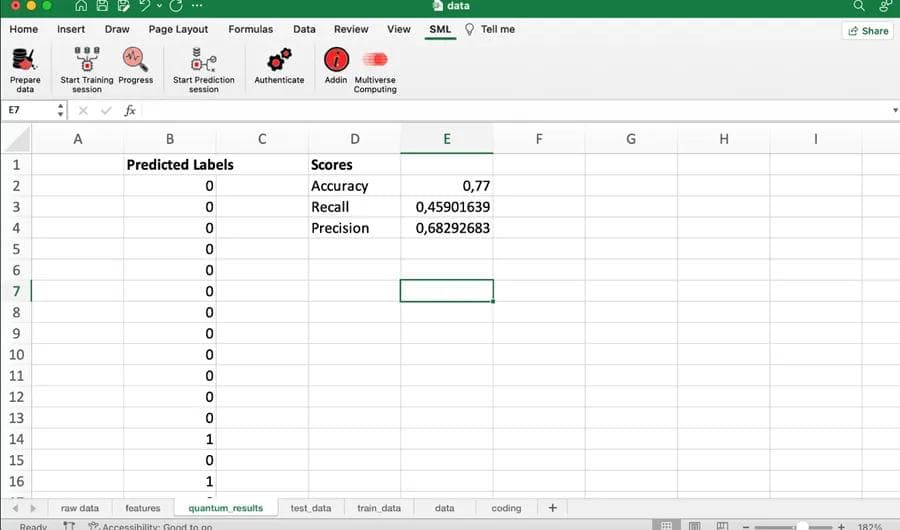

Singularity loads the default test data, which can be customized during the split of data in step 2. Labels can also be selected to compare the ground truth labels with predicted labels, allowing the user to compute evaluation metrics such as the accuracy, precision, and recall of the model.

Then, a “Quantum Results” page is created, assigning a prediction to each test example in terms of the 1 or 0 (repay/cannot repay) established in step 1.

Results

For this use-case, the quantum model outperformed the classical linear regression model across all standard metrics, including accuracy (77% vs 74.8%), recall (45.9% vs 40.7%), and precision (68.3% vs 62.2%).

Based on our past experience, an important KPI is the number of clients falsely predicted as default, as this could lead to the bank losing its clients. While the classical solution resulted in 37.8% false positives, the quantum solution had only 31.7%, a significant reduction of 16%.

How do you need to get started?

Here’s what you need to begin using quantum machine learning techniques today:

· Windows 10

· Excel

· Singularity Add-in

· Authentication key (provided to add-in users by Multiverse)

Users of Singularity also have access to a user guide for help with installation, authentication, preparing data, training your model, potential problems, and general guidelines.

Contact us here to learn more.

Article published on Medium here.